Forex trading options offer a flexible way to make profits in the currency markets. Many traders find this approach advantageous, allowing for diverse strategies and a better risk management profile. While forex trading and options trading are two distinct financial instruments, their integration offers opportunities for profit on various levels. If you’re looking to delve into this field, forex trading options Trading Brokers in Qatar can provide valuable insights and resources.

What Are Forex Trading Options?

Forex trading options, essentially, are contracts that give the buyer the right, but not the obligation, to buy or sell a currency pair at a specified price, on or before a certain date. This capability introduces multiple strategies and a range of risk management tools, making forex trading options an appealing choice for both novice and seasoned traders.

Types of Forex Options

- Call Options: The right to buy a currency pair at a predetermined price.

- Put Options: The right to sell a currency pair at a predetermined price.

These options can be executed either before their expiration date (American style) or solely at the expiration date (European style). Understanding these types helps traders make efficient decisions based on their market outlook.

Why Trade Forex Options?

Trade forex options for several reasons, including:

- Leverage: Forex options provide traders with a level of leverage, allowing them to control a larger position with a smaller amount of capital.

- Risk Management: Options can serve as insurance for positions, allowing traders to hedge against adverse market movements.

- Flexibility: Multiple strategies can be implemented using options, such as spreads and straddles, depending on market conditions.

- Profit in Various Market Conditions: Options can be structured to profit from market volatility or range-bound movements, giving traders more potential opportunities.

Key Strategies for Forex Options Trading

Traders can adopt various strategies when dealing with forex options. Here are some popular ones:

1. Covered Call

This strategy involves holding a long position in a currency pair while simultaneously selling call options on that pair. This position generates income through the premiums collected from selling the calls.

2. Protective Put

A protective put strategy consists of holding a position in a currency pair while buying a put option. This serves as a hedge against potential losses, essentially serving as an insurance policy.

3. Straddles and Strangles

These strategies are used when a trader anticipates significant volatility but is unsure of the direction of the price movement. A straddle involves buying both a call and a put at the same strike price, while a strangle involves buying options at different strike prices.

Understanding Risks Involved

While forex options bring numerous advantages, they also bear risks that traders need to be aware of:

- Premium Costs: The cost of buying options can impact profitability; if the price movement does not occur as expected, losses can arise from the premium paid.

- Time Decay: Options have an expiration date, and as it approaches, the time value decreases, potentially leading to losses if the market doesn’t move favorably.

- Complexity: The various strategies and underlying complexities of options may prove challenging for inexperienced traders.

Choosing the Right Broker

Trading forex options necessitates a solid broker. Here’s what to consider:

- Regulation: Ensure that your broker is regulated by a recognized authority.

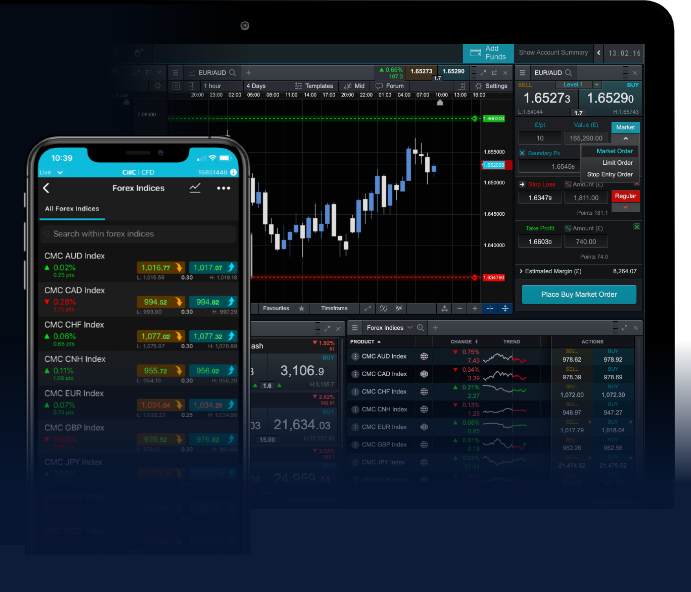

- Trading Platform: Look for a user-friendly and reliable trading platform that suits your trading style.

- Customer Support: A responsive customer support system is crucial, especially when experiencing technical issues.

- Educational Resources: Opt for brokers that offer educational materials, webinars, and tools to aid your trading journey.

Final Thoughts

Engaging in forex trading options can open new doors for traders willing to learn and adapt. Understanding the intricacies of this market, the available strategies, and the inherent risks can significantly enhance your overall trading experience. As with any trading endeavor, practice proper risk management and continuously refine your strategies to stay ahead of market trends.

As you embark on your journey in forex trading options, stay informed, seek guidance from reliable sources, and actively engage with trading communities to share experiences and insights. With diligence and discipline, forex trading options could become a fruitful niche in your trading career.