Understanding Forex Trading: Definition, Benefits, and Strategies

Forex trading, or foreign exchange trading, is the process of exchanging one currency for another in the global marketplace. As the world’s largest financial market, the foreign exchange market facilitates the buying and selling of currencies, allowing traders to capitalize on fluctuations in exchange rates. This dynamic environment attracts investors ranging from individuals to large institutions. To get started, it’s essential to have a clear understanding of what forex trading is and how it operates. You can find the forex trading definition Best Platforms for Trading that suit your needs.

What is Forex Trading?

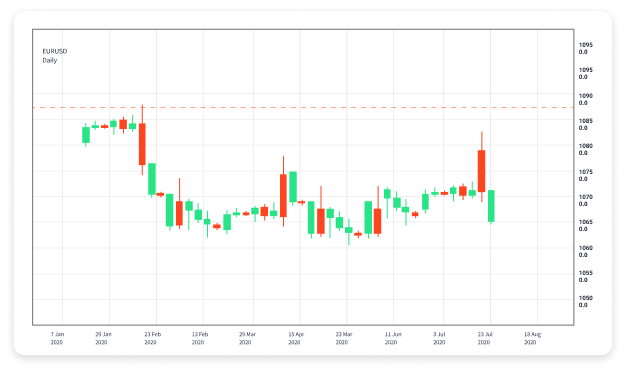

Forex trading involves the simultaneous buying of one currency and selling of another. Currencies are traded in pairs, where the value of one currency is compared to another, such as EUR/USD (Euro/US Dollar) or GBP/USD (British Pound/US Dollar). The forex market operates 24 hours a day, five days a week, making it accessible to traders worldwide.

The Importance of Currency Pairs

Understanding currency pairs is crucial in forex trading. Each pair represents a “base currency” and a “quote currency.” The base currency is the first currency in the pair, and its value is always 1. The quote currency is the second and indicates how much of the quote currency is needed to purchase one unit of the base currency. For example, if the EUR/USD exchange rate is 1.15, it means 1 Euro can be exchanged for 1.15 US Dollars.

Types of Forex Market Participants

The forex market includes various participants, each with distinct roles:

- CENTRAL BANKS: Control monetary policy and influence currency values through interest rate adjustments and other operations.

- INSTITUTIONAL INVESTORS: Include banks, hedge funds, and pension funds that engage in large volume trading.

- RETAIL TRADERS: Individual traders who participate in the forex market, often using online trading platforms.

- BUSINESSES: Use forex to hedge against currency risk when engaging in international trade.

Benefits of Forex Trading

The forex market offers several advantages for traders:

- Liquidity: The forex market is highly liquid, allowing traders to enter and exit positions quickly without significant price changes.

- Accessibility: With online trading platforms, forex trading is accessible to anyone with an internet connection and a trading account.

- Leverage: Forex brokers often provide significant leverage, enabling traders to control larger positions with a smaller amount of capital.

- Diverse Trading Options: Traders can speculate on various currency pairs, commodities, and even cryptocurrencies.

Key Concepts in Forex Trading

Successful forex trading requires knowledge of several key concepts:

- SPREAD: The difference between the bid (selling price) and the ask (buying price) of a currency pair. It represents the cost of trading.

- PIPS: The smallest price movement in a currency pair is usually the fourth decimal place, except for pairs involving the Japanese Yen, where it is the second decimal place.

- LOT SIZE: Refers to the quantity of units traded. Standard lots are 100,000 units, mini lots are 10,000, and micro lots are 1,000.

- MARGIN: The amount of equity needed in a trading account to open a position. Leverage increases the effective trading power.

Common Trading Strategies

Various trading strategies exist in forex, catering to different trader styles:

- SCALPING: Involves making numerous small trades throughout the day, aiming for small profits.

- DAY TRADING: Traders buy and sell within the same trading day, avoiding overnight positions.

- SWING TRADING: Involves holding positions for several days to capture price swings.

- POSITION TRADING: Traders hold positions for weeks, months, or even years, focusing on long-term trends.

Risks Associated with Forex Trading

While forex trading offers opportunities, it also comes with risks. The most notable risks include:

- MARKET RISK: The risk of losing money due to unfavorable currency movements.

- LEVERAGE RISK: While leverage can magnify gains, it can also amplify losses significantly.

- INTEREST RATE RISK: Changes in interest rates can impact currency values and affect trading positions.

- COUNTERPARTY RISK: The risk that the broker may default on financial obligations, though this is minimized with regulated brokers.

Conclusion

Forex trading is a complex but rewarding activity that attracts individuals and institutions worldwide. By understanding its definition, the various participants, benefits, key concepts, and associated risks, traders can better navigate this dynamic market. As you embark on your trading journey, consider exploring different strategies, managing risks, and continually educating yourself. With discipline and a solid trading plan, forex trading has the potential to yield substantial returns.